Dear customers and friends:

As you are aware, as part of the Tax reforms for 2022, and in particular those made to the Federal Tax Code, the new tax obligation related to the figure of the “controlling beneficiary” is established, which from the 1st of January 2022, will have to complied with by the taxpayers legal entities, trustees, settlors, trusts and other legal figures.

In this sense, to define what the figure of the controlling beneficiary is in accordance with the provisions of article 32-B Ter of the Federal Tax Code (CFF), the controlling beneficiary will be understood as the natural person or group of natural persons, that:

- Directly or through others or from any legal act, obtains the benefit derived from their participation in a legal person, a trust or any other legal figure, as well as from any other legal act, or it is who ultimately exercise the rights of use, joy, enjoyment, use or disposal of a good or service.

- Directly or indirectly or contingently, exercises control of the corporation, trust or any other legal entity. In this sense, it is understood that a natural person or group of natural persons exercises control when, through the ownership of securities, by contract or by any other legal act, they can:

- Impose, directly or indirectly, decisions in the general meetings of shareholders, partners or equivalent organizations, or appoint or dismiss the majority of the directors, administrators or their similar.

- Maintain ownership of the rights that allow, directly or indirectly, to exercise the vote with respect to more than 15% of the share capital or good.

- Direct, directly or indirectly, the administration, strategy or main policies of the legal entity, trust or any other legal entity.

- Trusts: The trustor or trustors, the trustee or trustees, as well as any other person involved and who ultimately exercises effective control in the contract, even contingently, will be considered controlling beneficiaries.

Continuing with what was commented in the previous paragraphs, on December 27, 2021, rules 2.8.1.20, 2.8.1.21, 2.8.1.22 and 2.8.1.23 of the Miscellaneous Tax Resolution for 2022 were published in the Official Gazette of the Federation (DOF), focused on regulating compliance with the obligations regarding the controlling beneficiary contained in articles 32-B Ter, 32-B Quáter and 32-B Quinquies of the CFF, in this sense, the most relevant characteristics of the aforementioned rules are mentioned below.

In the case of the chain of ownership or chain of control referred to in article 32-B Ter of the CFF, rule 2.8.1.20. of the RMF establishes that the following information must be available:

- Name, denomination or trade name of the legal entity or entities, trusts or legal figures that have participation or control over the legal entity, trusts or legal figures.

- Country or jurisdiction of creation, constitution or registration.

- Country or jurisdiction of residence for tax purposes.

- The RFC or tax identification number, or its equivalent, in case of being a resident abroad, for tax purposes.

- Fiscal domicile

For its part, rule 2.8.1.21 of the RMF establishes the mechanisms to identify, verify, obtain and keep the updated information of the controlling beneficiary, mainly establishing duly documented internal control measures, which are reasonable and necessary, to obtain said information and that will be part of the accounting of each corporation or legal figure, and are as follows:

I. Properly identify, verify and validate the controlling beneficiary of legal entities, escrows and any other legal entity.

For purposes of the foregoing, the legal entities, the trustees, the settlors or trustees, in the case of trusts, as well as the contracting parties or members, in the case of any other legal figure, as appropriate, will require a (the) person(s) who can be considered as controlling beneficiary(ies), in accordance with the provisions of article 32-B Quáter of the CFF, to reveal their identity, and provide the information detailed in the rule 2.8.1.22.

II. Obtain, keep and maintain available the reliable, complete, adequate, precise and updated information about the identity data of the controlling beneficiary and other data established in rule 2.8.1.22., for which, legal entities, trustees, the settlors or trustees, in the case of escrows, as well as the contracting parties or members, in the case of any other legal figure, as appropriate, must establish procedures so that the person(s) who may consider themselves controlling beneficiary(ies) to provide them with updated information on their status as such, as well as to inform them of any change in their status, in order to be able to comply with the provisions of article 32-B Quinquies, first paragraph of the CFF.

III. Preserve the information of the controlling beneficiary, the chain of ownership and the chain of control, the documentation that supports it, as well as the supporting documentation of the internal control procedures referred to in the first paragraph of this rule, during the term indicated in article 30 of the CFF.

IV. Provide, allow the timely access of the tax authorities and grant them all the facilities to access the information, records, data and documents related to the controlling beneficiaries.

The purpose of this is mainly focused on having the appropriate procedures to identify the controlling beneficiary or beneficiaries of the obligated taxpayers as part of their accounting (rule 2.8.1.22 of the RMF), in this sense, for their file, the following information must be collected, referring to each controlling beneficiary:

I. Full names and surnames, which must correspond to the official document with which the identity has been accredited.

II. Alias.

III. Date of Birth. When applicable, date of death.

IV. Gender.

V. Country of origin and nationality. In case of having more than one, identify them all.

VI. CURP or its equivalent, in the case of other countries or jurisdictions.

VII. Country or jurisdiction of residence for tax purposes.

VIII. Type and number or ID of the official identification.

IX. The RFC or tax identification number, or its equivalent, in case of being a resident abroad, for tax purposes.

X. Marital status, with identification of the spouse and property regime, or identification of the concubine, if applicable.

XI. Contact information: email and telephone numbers.

XII. Private address and tax domicile.

XIII. Relationship with the corporation or quality that holds in the trust or the legal figure, as appropriate.

XIV. Degree of participation in the corporation or in the trust or legal figure, which allows it to exercise the rights of use, joy, enjoyment, exploitation or disposal of a good or service or carry out a transaction.

XV. Description of the form of participation or control (direct or indirect).

XVI. Number of shares, partnership interests, participations or rights or equivalents; series, class and nominal value of the same, in the capital of the corporation.

XVII. Place where the shares, partnership interests, participations or other equivalent rights are deposited or in custody.

XVIII. Specific date from which the natural person acquired the status of controlling beneficiary of the legal person, trust or any other legal figure.

XIX. If applicable, provide the data mentioned in the preceding sections regarding who or who hold the position of sole administrator of the legal entity or equivalent. In case that the legal person has a board of directors or an equivalent organization, of each member of said board.

XX. Date on which a change occurred in the participation or control in the corporation, trust or any other legal entity.

XXI. Type of modification of the participation or control in the corporation, trust or any other legal figure.

XXII. Date of termination of the participation or control in the corporation, trust or any other legal figure.

It is important to mention that taxpayers required to comply with this tax provision must analyze their internal control mechanisms and procedures with the intention of not only obtaining the information but also keeping it updated at least every time there are significant changes, in that sense, it is recommended to have the information available in case of a review by the tax authorities, among others, the following documents:

- Constitutive Act of the Corporations.

- Meeting’s minutes of partners and/or shareholders in which the entry or exit of any of them is agreed upon or an increase or decrease in share capital is decreed.

- Notices submitted to the Electronic System of Publications of Commercial Companies (PSM) of the Ministry of Economy.

- Corporate Books of registers of partners or shareholders; increase and decrease of the social capital and general meeting of partners or shareholders.

- Powers for acts of administration and ownership.

- Minutes of mergers and/or divisions.

- Registrations before the Public Registry of Property and Commerce.

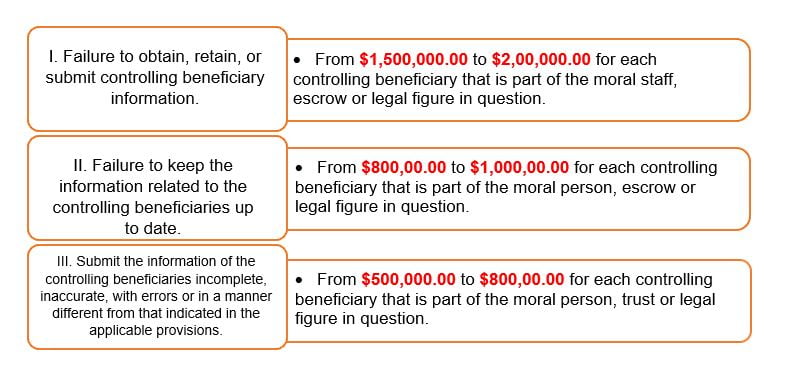

Last but not least, it should be noted that, in case of non-compliance with this new obligation, the tax authorities could apply the following sanctions in accordance with articles 84-M and 84-N of the CFF:

In this sense, the SAT will notify the request for information from its controlling beneficiaries in accordance with the provisions of article 134 of the CFF. Said information must be provided within a period of 15 business days following the date on which the notification of the request takes effect. This period may be extended by the tax authorities for an additional 10 days, as long as a duly justified request for an extension is submitted prior to compliance with the aforementioned period, and it is authorized by said authorities.

Based on all of the above, we reiterate the importance of maintaining an adequate file with all the information and documentation that the tax authorities require to demonstrate the veracity of the identity of the controlling beneficiary, since from 2022 it must be part of the taxpayers’ accounting, so it is important to be up to date and act promptly in this situation to avoid sanctions.

As always, we are at your service for any clarification, doubt or support you may require in order to correctly comply with your tax obligations.

The purpose of this bulletin is to inform about the most important publications on tax matters, without it intending to present the opinion of our Firm on the aspects discussed; each case must be carefully analyzed to conclude on the correct interpretation of the provisions discussed here.